The meeting of European Finance Ministers held in Luxembourg on Thursday, June 18 failed to make further inroads towards unlocking the Greek agreement negotiations. The European Central Bank (ECB) has increased the amount of emergency funds to Greek Banks that have been hit by the uncertainty about the fate of the country’s finances that has triggered massive withdrawals. The Eurogroup will try again to bring the two sides together on a Monday, June 22 emergency meeting. The forex market will be awaiting the outcome with the hope an agreement can finally be reached.

As talks broke down in Luxembourg thousands of Greek protesters gathered outside parliament in Athens on Thursday. The main message was that the government should avoid default and remain within the Eurozone, which entails taking the existing deal. The protest was heavily attended by members of the opposition party . A rally the day before that supported Prime Minister Alexis Tsipras’ decision to stick to their negotiation efforts with similar if not higher numbers. The size of both protests was smaller than in previous demonstrations and shocking given the fate of Greece hangs in a balance as the IMF repayment deadline approaches.

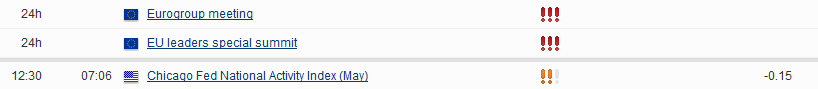

Monday, June 22

All Day Emergency Eurogroup Meeting to discuss Greece

10:00am USD Existing Home Sales

9:45pm CNY HSBC Flash Manufacturing PMI

Tuesday Jun 23

3:00am EUR French Flash Manufacturing PMI

3:30am EUR German Flash Manufacturing PMI

5:00am GBP Inflation Report Hearings

8:30am USD Core Durable Goods Orders m/m

Wednesday, June 24

4:00am EUR German Ifo Business Climate

8:30am USD Final GDP q/q

Thursday, June 25

8:30am USD Unemployment Claims

6:45pm NZD Trade Balance

The USD was rocked by the Federal Open Market Committee (FOMC) statement that had a dovish undertone regarding the timing of impending higher interest rates. The US Federal Reserve is sticking to the plan to raise the benchmark interest rate before the end of the year, yet the pace and forecasts of where policy members see the rate in the future has been downgraded. September continues to be the key FOMC meeting where the much awaited first rate hike will be announced, that is if the U.S. economy complies.

The U.S. economy had mixed data release during the week. Inflation came in under expectation at 0.4 percent after a 0.5 percent growth was expected. Unemployment claims continue to impress with a decline of 12,000 new claims from the previous week. The Philadelphia Fed Manufacturing Index surprised with a 15.2 reading crushing the expected 8.1. The recovery in the Philadelphia region increased from a reading of 6.7 in May boosting the dollar with positive news on the manufacturing front that has been affected by a strong currency.

From the currency moves after the FOMC it was clear that while Greece might grab more headlines it is the U.S. economy and the Fed that are moving the markets. The lack of commitment from the U.S. central bank to a date is not seen as a show of force. The September meeting is the most likely candidate for the announcement of higher benchmark interest rates of the world, thus marking the end of low rates era, at least in the U.S.

There are rising doubts about what would happen after the first rise. Originally the market had priced in a strong pace of rate hikes, that now appears unlikely given the mixed signals thrown by the economy. The abandoned “forward guidance” and other signalling devices used by central banks to avoid unwanted volatility have left a huge void to fill. Uncertainty and volatility have filled that void as the Fed is putting the timing on the decision on the pure indicators, rather than the analysis and forecast of said economic figures. This is the environment that makes the Greek situation so precarious as there is little needed to rock the boat.

The recently elected Greek government is using that to their advantage, or at least they are trying to as it could all end up with unwanted consequences for all party. The Greek accident rather than a planned Grexit. Greek PM Alexis Tsipras and his inner circle are faced with two worst case scenarios. Accept the deal as is, resulting in unhappy citizens as essential services are cut to achieve unattainable targets set by bureaucrats or refuse the deal, face default and rebuilding of a nation’s economy. Its no wonder Tsipras and Varoufakis are pushing for a third option that does not currently exist. The hardest part has been convincing the European Union and the IMF to go along with this third option that while not the worst possible outcome for creditors, does not rank as high as just going along with the original agreement.

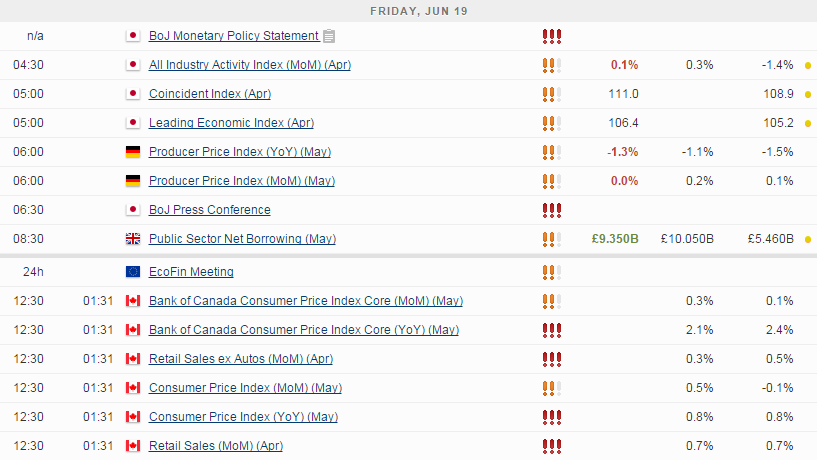

EUR events to watch this week:

Tuesday Jun 23

3:00am EUR French Flash Manufacturing PMI

3:30am EUR German Flash Manufacturing PMI

Wednesday, June 24

4:00am EUR German Ifo Business Climate

*All times EDT

For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar

China Flash PMI to Show Continued Slowdown Fears

China’s economy has posted mixed figures of late. Next week will see the release of the HSBC Flash manufacturing purchasing managers index (PMI). The results of the preliminary survey of purchasing managers in the manufacturing industry has struggled to register above 50 since February. A reading above 50 is considered expansion, while anything under that reading is a contraction. The Chinese PMI was published last month at 49.1. China’s economic rise boosted global growth and increase production of commodities to satisfy Chinese demand. The slowdown of the economy is one of the major risk factors impacting global growth. Internal demand has not offset the lost exports and Bank of China economists are now forecasting a turnaround in the second half of the year. The Chinese premier has warned the market about slower growth to avoid a sudden crash as indicators underperform. The central bank has already cut rates three times this year in an effort to stimulate the economy along with other measures, but it is too early to tell if they will have the desired effect.

The International Monetary Fund (IMF) said at the end of May that the Yuan was no longer overvalued. The Washington based organization went further and suggested that if the currency wants to be included in the Reserve Assets Basket it should move towards a free floating rate of exchange. China is caught in a difficult balancing act. Short term growth needs to be boosted in order to avoid falling further behind but at the same time long term objectives that include much needed structural reforms need to happen to secure long term goals. A free floating exchange falls into the second category, but it is not a priority if Beijing cannot guide China to a soft landing in the current macro climate.

The Chinese PMI disappointed last month by missing expectations at 49.1 when 49.4 was expected. The contraction was worse than forecasted and the leading indicator was a bad sign to commodity exporting nations like Australia and New Zealand that count China as their main trading partners.

China events to watch this week:

*All times EDT

For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar

GBP Gains on Greek Turmoil as Deflation Avoided

The pound received a boost from inflation numbers in the United Kingdom released on Tuesday, June 16. The price of goods and services rose by 0.1 percent. The fear that the deflation experienced last month was to be permanent was broken by a small, but important growth that validates Bank of England (BoE) Governor Mark Carney that deemed it transitory. He is sure to follow on this line of thinking when he faces parliament on Wednesday, June 24 to face queries on the BoE’s Inflation Report.

While the U.K. narrowly avoided deflation, the risk remains of falling behind yet again as inflation is not due to pick up to near the central bank’s target until 2016 as per Carney. Inflation will continue at current levels, which will keep rates low in the United Kingdom until the small rebound in inflation proves to be part of an upward trend in consumer prices.

Cable has thrived under the Greek turmoil. Strong retail sales and wage growth after dodging the deflation trap has boosted the GBP/USD to seven month highs. The pound gained 2.05 percent during the week against the USD and 1.28 versus the EUR. GBP/USD had a weekly high of 1.5928, while EUR/GBP reached 0.7251. Mergers and Acquisitions activity will keep the pound bid as the Greek situation continues to add uncertainty to the market.

Monday’s Eurogroup meeting is likely to end with no agreement, but European Finance Ministers could find a way to kick the can down the road. They will have to attempt that without the International Monetary Fund that has already said will give Greece no grace period in its debt repayment obligations. The European Central Bank (ECB) has made no such threats, and its addition of emergency funds to add liquidity to Greek banks speaks of a more amicable relationship, that could result in an extension that could avoid Greece running out of cash as its financial institutions suffer major withdrawals.

GBP/USD events to watch this week:

Tuesday Jun 23

5:00am GBP Inflation Report Hearings

*All times EDT

For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar