Tuesday’s sell-off in Europe has been largely put down to end of quarter profit taking by investors, following an incredible first quarter, so you could be forgiven for expecting stocks to continue their ascent today. Early indications, however, suggest that is not going to be the case which is fairly unusual with the first day of the second quarter usually being a good one for stock markets.

Yesterday’s end of quarter profit taking was far from an unusual occurrence but as it is usually put down to that, we usually see more of an appetite on the first trading day of April. The fact that European futures are not only in the red, but heavily so, may suggest that investors are anticipating some turbulence ahead and have therefore opted to ignore the trend.

This may have a lot to do with the failure of Greece to offer an acceptable list of reforms with its lenders once again labelling it nothing more than a list of ideas. Repeatedly we’ve heard that Alexis Tsipras’ has submitted insufficient alternatives to its lenders that contain the kind of convincing details that would convince them to release the funds. It’s getting to the point where you wonder whether this is an intentional ploy to drag out these negotiations and frustrate its lenders or just inexperience and poor leadership. Unfortunately for Greece and the euro area, it’s probably the latter.

From a investor perspective it’s far from ideal as once again it just drags out the negotiations and brings us closer to the point at which Greece’s defaults on its debts, which could come as early as 9 April when a repayment of €450 million is owed to the IMF. This makes Greece’s reported meeting with Russia on 8 April very interesting, and worrying, as Greece may accept a loan as an alternative to the bailout extension. Given the soured relationship between Russia and Europe, you can only imagine that Greece’s lenders would be furious with this.

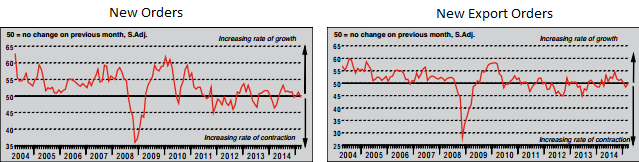

Also feeding into the weak start this morning may be the weak data that came from Japan and China overnight. While the official Chinese manufacturing PMI managed to scrape out a growth figure following two sub-50 readings, the HSBC reading remained in contraction territory despite slightly beating estimates. While both PMI readings technically beat expectations, the new orders and export sub components in the official PMI both fell which doesn’t bode well. With Chinese shares rallying off the back of this report, it’s clear that investors view it as further evidence that more monetary stimulus is both warranted and inevitable.

Plenty more data will be released this morning, most notably the manufacturing PMIs for much of Europe. These are not preliminary readings though so market reaction may be a little muted. That said, there has been a stark improvement in confidence in the Eurozone so these may be prone to revisions.

There’s plenty more data to come from the US later including the ADP non-farm employment reading, an estimate of Friday’s official non-farm payrolls figure, albeit usually an unreliable one. It will be interesting to see how people respond to it given that Friday is a holiday in much of Europe and some US markets will also be closed.

The FTSE is expected to open 51 points lower, the CAC 43 points lower and the DAX 123 points lower.

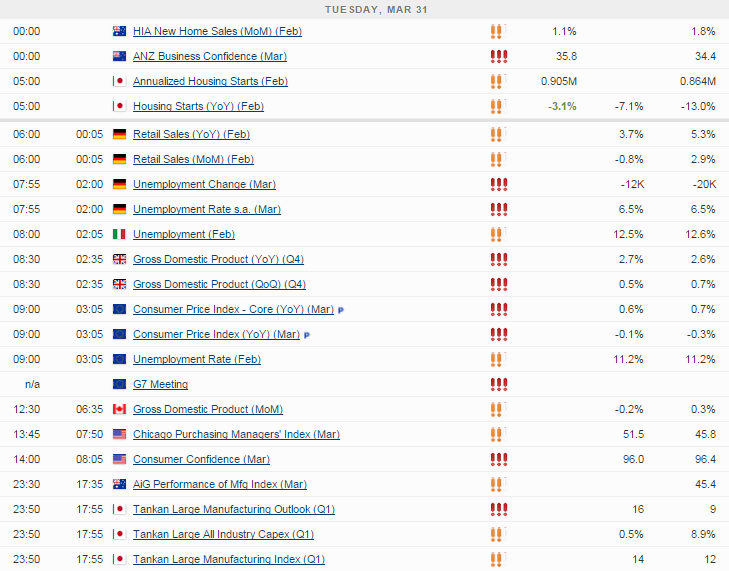

For a look at all of today’s economic events, check out our economic calendar.