Gold for Friday, May 1, 2015

In in the last 24 hours Gold has fallen sharply back down through the key $1200 level down to below another support level around $1180. It is now consolidating right around $1185 after enjoying some support around $1180. To start this new week Gold was trying to rally higher and regain lost ground from the end of last week which saw it drop to near $1175. The support at $1180 did well to keep it propped up as it has done again in recent hours. In the last couple of weeks, gold has traded in a narrow range right around the key $1200 level and this range had been getting tighter, although to close out last week it drifted lower and fell to a one month low. Gold has had an attraction to the key $1200 level as every time it ventures away it returns quickly to trade right around it. Several weeks ago gold sprung to life surging higher away from the key $1200 level back to a seven week high above $1220 before easing back and finding some support at the key $1200 level. Back at end of March gold eased a little for a few days to below $1185, although for the best part of the last few weeks gold has moved strongly off the support at $1150 and then found some new support from the $1200 level.

Throughout the second half of February gold enjoyed rock solid support from the key $1200 level which held it up on numerous occasions. For about a month gold drifted steadily lower down to a one month low near the key $1200 level before finding the solid support at this key level. At the beginning of December gold eased lower away from the resistance level at $1240 yet again back down to below $1200. During the second half of November gold made repeated runs at the resistance level at $1200 failing every time, before finally breaking through strongly. Throughout the first half of November Gold enjoyed a strong resurgence back to the key $1200 level where it has met stiff resistance up until recently.

Throughout the second half of October gold fell very strongly and resumed the medium term down trend falling from above $1250 back down through the key $1240 level, down below $1200 to a multi year low near $1130. It spent a few days consolidating around $1160 after the strong fall which has allowed it to rally higher in the last couple of weeks. Earlier in October Gold ran into the previous key level at $1240, however it also managed to surge higher to a five week high at $1255. In late August Gold enjoyed a resurgence as it moved strongly higher off the support level at $1275, however it then ran into resistance at $1290. In the week prior, Gold had been falling lower back towards the medium term support level at $1290 however to finish out last week it fell sharply down to the previous key level at $1275.

Gold fell 2 percent on Thursday after better-than-forecast U.S. jobs data encouraged investors to sell the traditional safe-haven market, reviving expectations the Federal Reserve could raise interest rates soon. Data on Thursday showed claims for state unemployment benefits declined 34,000 to a seasonally adjusted 262,000 for the week ended April 25, the lowest reading since April 2000. Separately, U.S. consumer spending rose 0.4 percent last month after rising 0.2 percent in February, while the Chicago Purchasing Management Index jumped more than expected in April. Spot gold was heading for its biggest daily fall since March 6, dropping as much as 2.3 percent to a session low of $1,176.80 an ounce earlier. It was last lower at $1,182.50 an ounce, on track to finish April down a shade for its third straight month lower. U.S. gold futures for June delivery settled down $27.60 an ounce, or 2.3 percent, at $1,182.40. It looks like the trigger (for today’s weakness) was the U.S. data, with strong jobs creation,” Saxo Bank senior manager Ole Hansen said.

(Daily chart / 4 hourly chart below)

Gold May 1 at 00:50 GMT 1184.6 H: 1207.7 L: 1177.1

Gold Technical

S3

S2

S1

R1

R2

R3

1180

1150

—

1240

1300

—

During the early hours of the Asian trading session on Friday, Gold is consolidating after its recent sharp fall back to the support level around $1180. Current range: trading right around $1185.

Further levels in both directions:

• Below: 1180 and 1150.

• Above: 1240 and 1300.

OANDA’s Open Position Ratios

![]()

(Shows the ratio of long vs. short positions held for Gold among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for Gold has moved back to near 75% as it has fallen sharply back through the key $1200 level to below $1180. The trader sentiment is strongly in favour of long positions.

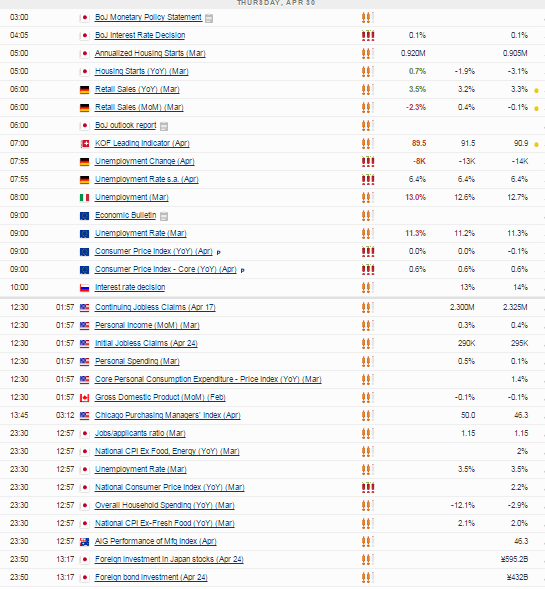

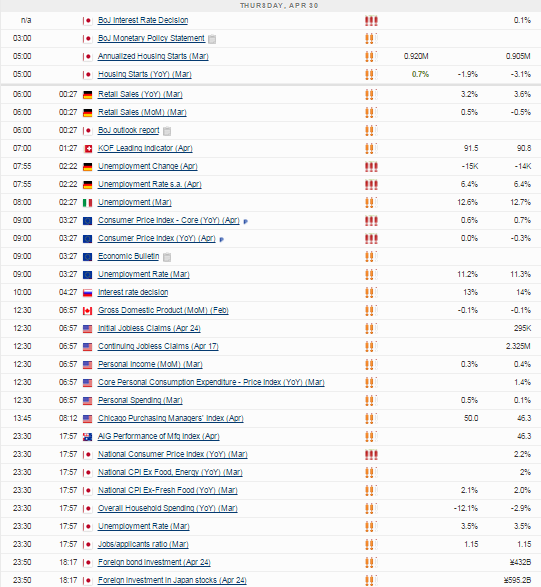

Economic Releases

01:30 AU PPI (Q1)

08:30 UK BoE – Mortgage Approvals (Mar)

08:30 UK BoE – Net Consumer Credit (Mar)

08:30 UK BoE – Secured Lending (Mar)

08:30 UK CIPS/Markit Manufacturing PMI (Apr)

08:30 UK M4 Money Supply (Mar)

13:45 US Manufacturing PMI (Apr)

14:00 US Construction Spending (Mar)

14:00 US ISM Manufacturing (Apr)

14:00 US Univ of Mich Sent. (Final) (Apr)

US Vehicle Sales (Apr)

* All release times are GMT

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.